This month we read the classic sci-fi novel, Do Androids Dream of Electric Sheep? The book follows Rick Deckard, a bounty hunter searching out android robots who are pretending to be human beings. Along the journey, the reader is asked to consider: what does it mean to be alive? Philip K. Dick was a crazy sci-fi writer, producing many books and stories that became famous like The Man in the High Castle, Minority Report, and Total Recall. Although his writing career was prolific, Dick was a troubled individual. He was a heavy drug user, he married five times, he experienced drug-induced “paranormal activities” and he was physically abusive to at least two of his wives. While

Tech Themes

The common, modern depiction of a Turing Test

Are you an android? In 1950, British computer scientist Alan Turing conceived of the Turing Test, a hypothetical test to determine whether a machine can display intelligent behavior. Turing asked the question, “Can machines think?” and attempted to define a test whereby a human might be tricked into believing a machine was human. The test design is fairly complex but involves a human asking written questions to a machine in another room. If the machine can convince the interrogator that it’s human, then machines can “think.” This Turing test is mirrored in the Voigt-Kampff test used throughout the book. It’s unclear if the test works, and Rick Deckard almost misdiagnoses Rachel in the book's early parts. At the end of the book, the test is turned on its head, with Rick impersonating John Isidore (another human), trying to convince machines (in another room) to let him in. This role-reversal and the questioning of who is an android happens throughout the novel - at times, Rick, Phil Resh, and Harry Bryant might all be androids. These questions are the centerpiece of sci-fi lore. They are also explored in a similar style in the famous movie Ghost in The Shell, where people have now have some organs and limbs replaced by electric parts. When a cyber-attacker named the Puppet Master takes over the machine network of technological parts, it’s unclear who is human, who is an android, and who is possessed by the Puppet Master. In the video game world, this idea has also recently been explored in Detroit: Become Human. In the game, which is set up in choose-your-own-adventure style, players can play as humans or androids and choose whether they stay in character or break out of their controlled, android state. The idea of an interrogator or bounty hunter snooping out rogue machines has been explored across books, film, and video games. As technology has become more prevalent in our lives, the cultural mediums may have changed, but the classic philosophical question - what does it mean to be alive? - remains.

Predicting the future. The Blade Runner movie is famously set in Los Angeles, 2019, while the book is set in 1992 in San Francisco. The book itself was written in 1968, and the movie Blade Runner debuted 14 years later in 1982. In 2019, Blade Runner experienced a comic resurgence as its dark, bleak futuristic society of flying cars, fully intelligent artificial beings, and international space travel never happened. Today, predictions of computing and artificial intelligence abound. In his original Imitation Game paper, Alan Turing made one of the most famous AI predictions: “I believe that in about fifty years’ time it will be possible to programme computers, with a storage capacity of about 10^9, to make them play the imitation game so well that an average interrogator will not have more than 70 percent, chance of making the right identification after five minutes of questioning.” It’s tough to know if this prediction came true (other than the 10^9 part because that is only 1 GB), with some places claiming to have built algorithms that beat the Turing Test. Interestingly, one common theme emerges about these computing predictions - both experts and non-experts typically predict about 15-25 years out. In the Innovators, Walter Issacson posited that this was enough time to allow people to engage in imaginative thinking. Roy Amara, co-founder of the Institute for the Future, probably put it best: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” How long run is the long run, though? As John Maynard Keynes proclaimed: “In the long run we are all dead. Economists set themselves too easy, too useless a task if, in tempestuous seasons, they can only tell us that when the storm is long past the ocean is flat again.” It is seriously hard to estimate the combination of changing technologies and infrastructures, which unlock completely new and cost-effective ways of building things. Will we have self-driving cars in 20 years? Will we have Artificial General Intelligence? Will we have quantum computing? I have no idea.

Technology and nature. One theme repeatedly explored throughout the novel is this balance or tension between technology and nature. World War Terminus has caused a layer of radioactive dust to fall over the world, killing animal life and changing the environment. Mechanical animals are the norm, and Rick dreams about procuring a real horse, ostrich, or goat one day. He regularly checks his Sidney’s Animal & Fowl Catalogue like a stockbroker checking the latest price change. A real animal is significantly more expensive than a mechanical version, despite it being nearly impossible to figure out whether an animal is real or fake. This mirror’s the book's whole premise - a real human is more important and valuable than an Android despite increasingly small differences between Androids and humans. Rick realizes this at the end of the book: “The spider Mercer gave the chickenhead, Isidore; it probably was artificial, too. But it doesn't matter. The electric things have their lives, too. Paltry as those lives are." Technology and nature have a tradeoff in today’s world as well. Cloud computing is certainly energy-intensive, but according to the companies that run those clouds (like Google Cloud or Microsoft Azure), it is significantly less intensive than having companies run their own data centers. Beyond the environmental impact, the behavior of nature is something to consider when operating a data center. A few years ago, Facebook data centers went down when a Snake chewed through a switchboard and took down all services. In 2014, a shark bit through an underwater Google fiber cable, and in 2012 a squirrel took down a Yahoo data center. Animals, technology, and nature are constantly interacting, sometimes in unexpected ways.

Business Themes

Status seeking and the growth of e-commerce. In the battle to achieve status, real animals are a highly sought after status symbol. Early on in the book, Rick engages in a jealous conversation over his neighbor’s real horse: “‘Ever thought of selling your horse?’ Rick asked. He wished to god he had a horse, in fact any animal.” After revealing that his sheep was electric, Rick’s neighbor kindly remarks that he won’t tell the other people in the apartment complex, suggesting that if people knew Rick had an electric sheep (rather than a real one), they would look down on him. While this interaction seems weird, it parallels so many interactions people have today. Vance Packard offered a description of “status seekers” in 1959: “People who are continually straining to surround themselves with visible evidence of the superior rank they are claiming.” As general consumption and wealth rose after World-War II in the US, luxury goods became more attainable for more classes. Globalization of supply chains also increased this trend. When commerce moved online, new shopping styles and behaviors emerged. E-commerce purchases can frequently replace feelings and there is even a psychological disorder caused by excessive purchasing: Buying-shopping disorder (BSD) is characterized by extreme preoccupations with and craving for buying/shopping and by irresistible and identity-seeking urges to possess consumer goods. Patients with BSD buy more consumer goods than they can afford, and those are neither needed nor frequently used. The excessive purchasing is primarily used to regulate emotions, e.g. to get pleasure, relief from negative feelings, or coping with self-discrepancy.” Dick may be signaling that humans seek status and importance compared to their reference groups, regardless of setting or what indicates that status to others, whether it be an expensive handbag or a goat.

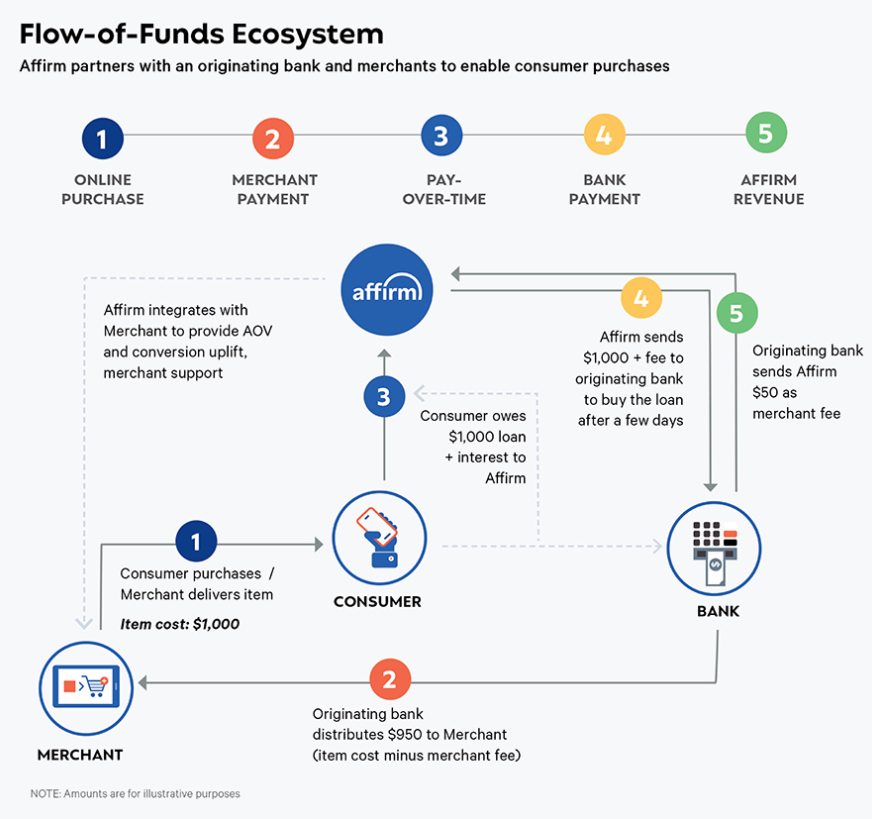

Buy goat now, pay-later. 2020 saw the emergence of buy-now, pay-later (BNPL) vendors like Affirm, Klarna, and Afterpay. These companies typically offer zero-interest loans to consumers and get paid a 5% merchant fee for increasing purchases at e-commerce stores. The stores (like Peloton for example) increase sales and the consumers benefit from not having to pay a significant upfront payment. The other way these companies make money is by charging interest payments on specific types of purchases (likely where the merchant doesn’t want to give away a fee). These interest rates can be really, really high - averaging around 10-30% depending on the purchase. This is not a new concept and the idea of payday loans at predatorily high-interest rates has been around for over 30 years. Luckily, the purchases that these BNPL providers are financing tend to not be really high-value products, but it’s still concerning that some people are buying things without understanding the true value they will have to pay in interest. When Rick purchases a real goat, after killing three androids, he finances it, paying $3,000 upfront and entering into a three-year payment contract. Rick’s wife Iran is outraged at the cost of the goat: "‘What are the monthly payments on the goat?’ She held out her hand; reflexively he got out the contract which he had signed, passed it to her. ‘That much,’ she said in a thin voice. ‘The interest; good god — the interest alone. And you did this because you were depressed. Not as a surprise for me, as you originally said.” With BNPL providers now securitizing these consumer loans and selling them off to banks, I wonder if we will see any new regulation come to bear for the benefit of consumers. If people are not careful, they could be locked into long contracts with significant interest over time.

Two case studies in electric animals. Electric animals have actually been invented and while they may not be the equivalent of Goddard from Jimmy Neutron yet, they are pretty funny and interesting case studies. Sony released the AIBO dog in 1999 after many years of research. The original robot dog cost $2,100 (~$3,500 in today’s dollars) and sold about 65,000 units. The programmable software allowed the dogs to be used in a variety of situations including an AI soccer world cup. The initial popularity of the dogs waned, and price wars with new rivals caused sales to decline. In 2006, the AIBO dog was discontinued. In 2018, it made a resurgence and is now a barking flexible model that you can pet, play games with, and feed. Another tale of odd mechanic animals is Boston Dynamics. The company that spun out of MIT in 1992 produced massive quadruped animals including one called BigDog, that was capable of balancing, walking up-hill, and carrying significant amounts of equipment. The Company had trouble selling products though and was acquired by Google in 2013 for an undisclosed sum. This came at a time when Google was pushing heavily into robotics with Google Glass and what would become Waymo - they literally titled this Project Replicant (the name used for Android in the Blade Runner film). After some more years of underperformance, Google sold Boston Dynamics to Softbank in 2017. After years of development, the company finally released a product to consumers for a whopping $75,000. The dog is still pretty creepy and comes without a real face, unlike the Aibo. In 2020, it was announced that Hyundai had acquired an 80% stake in the business at a $1.1B valuation. We are still years away from having electric animals that mimic real-life animals and that may be a good thing.