This book details a number of factors that have discouraged women’s participation and promotion in the tech industry. Emily Chang gives a brief history of the circumstances that have pushed women away from the industry and then covers its current issues - weaving in great insights and actionable takeaways along the way.

Tech Themes

The Antisocial Programmer. As the necessity for technological talent began to rise in the early 1960s, many existing companies were unsure how to hire the right people. To address this shortfall in know-how, companies used standard aptitude tests, like IBM’s Programmer Aptitude Test, to examine whether a candidate was capable of applying the right problem solving skills on the job. Beyond these standard aptitude tests, companies leveraged personality exams. In 1966, a large software company called System Development Corporation hired William Cannon and Dallis Perry to build a personality test that could shed light on the right personalities needed on the job. To build this personality test, Cannon and Perry profiled 1,378 programmers on a range of personality traits. Of those 1,378 profiled, only 186 were women. After compiling their findings, the final report stated: “[Programmers] dislike activities involving close personal interaction; they are generally more interested in things than people.” Furthermore, Cannon and Perry’s 82-page paper made no reference to women at all, referring to the surveyed group as men, for the entire paper. A combination of aptitude tests and Cannon-Perry’s personality test became the industry standard for recruiting, and soon companies were mistakenly focused on stereotypical antisocial programmers. Antisocial personality disorder is three times more common in men than women. Given how early the tech industry was, compared to what it is now, this decision to hire a majority of anti-social men has propagated throughout the industry, with senior leaders continually reinforcing incorrect hiring standards.

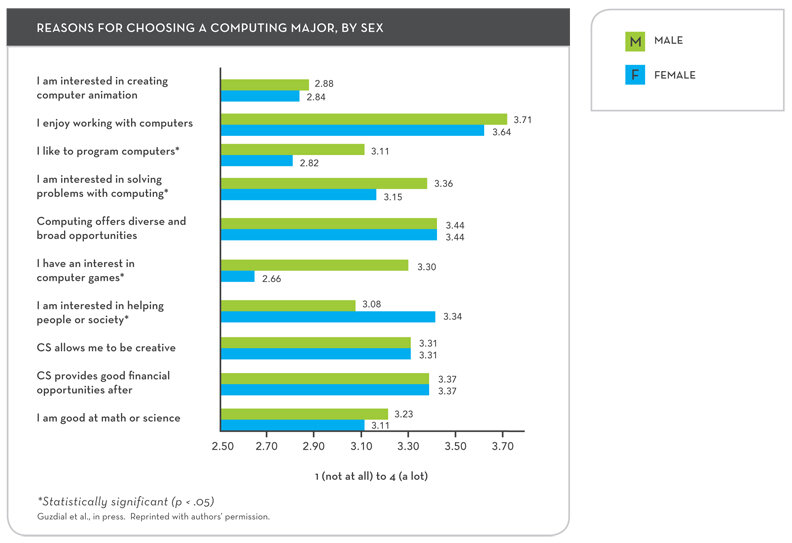

Women in Computer Science. According to the book, “there was an overall peak in bachelor’s degrees awarded in computer science in the mid-1980s, and a peak in the percentage of women receiving those degrees at nearly 40 percent. And then there was a steep decline in both.” It was at this time in the mid-1980s that computer science departments began to turn away anyone who was not a pre-qualified, academic top performer. There was too much demand with a constrained supply of qualified teachers, so only the best kids were allowed into top programs. This caused students to view computer science as hyper-competitive and unwelcoming to individuals without significant experience. Today, women earn only 18% of computer science degrees – a statistic that shocks many in the industry. Researchers at NPR found that intro CS courses play a key role in this problem – with many teachers still assuming students have prior familiarity with coding. Furthermore, women are socialized in a number of ways to achieve perfection, so when brand new code is not working well, women are more likely to feel discouraged. It is imperative to encourage women to try computer science if they have interest, to combat these negative trends.

PayPal and Perpetuating Cycles. After the dot-com bubble burst in the early 2000s, several newly minted millionaires did the natural thing after selling a company for millions of dollars, became a venture capitalists. One of the major success stories of the era was PayPal. Among those newly minted millionaires were the PayPal mafia: Peter Thiel, Keith Rabois, Elon Musk, Max Levchin, David Sacks, and Reid Hoffman. Thiel and Rabois have a history of suggesting a meritocratic process of hiring where only the most qualified academic candidate should land the job, not taking into account diversity of any form. Furthermore, in his book Zero to One (which we’ve discussed before), Thiel proposes startups should hire only “nerds of the same type.” The mafia began investing in several new companies, seeding friends who were likely to perpetuate the cycle of recruiting friends and hiring based on status alone. Rabois, who is currently a venture capitalist has remarked: “Once you have alignment, then I think you can have a wide swath of people, views and perspectives.” These ideas seem more like justification for hiring large groups of white males who were friends of PayPal executives than a truly “meritocratic” process, which is not the best way of building a successful, diverse organization. Roger McNamee, founder of technology private equity firm, Silver Lake, suggests: “They didn’t just perpetuate it; they turned it into a fine art. They legitimized it… The guys were born into the right part of the gene pool, they wind up at the right company, at the right moment in time, they all leave together and [go on] to work together. I give them full credit for it but calling it a meritocracy is laughable.”

Business Themes

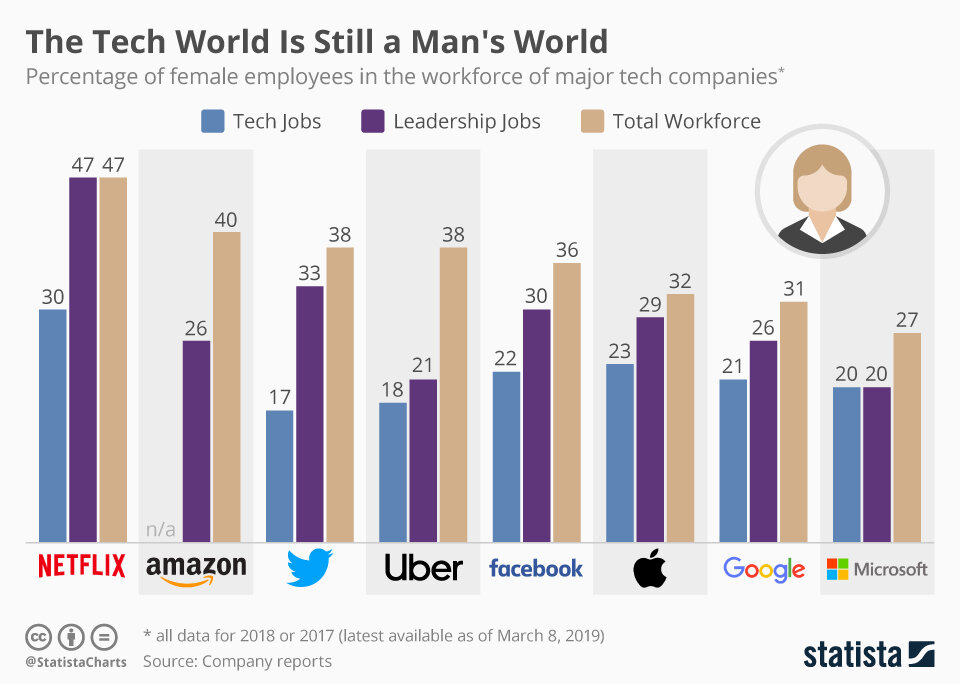

The Women at Early Google. A lot of people know the story of Sergey Brin meeting co-founder Larry Page. But few are aware of when Sergey and Larry met Susan Wojcicki, who is now CEO of YouTube. Sergey and Larry were looking for office space, and through a mutual friend, were introduced to Susan Wojcicki, who worked in marketing at Intel at the time. Though she didn’t jump on board immediately, Susan eventually came around and was instrumental in launching two of Google’s most important products: AdWords and AdSense. Wojcicki would soon be working closely with a newly recruited, Marissa Mayer, who after graduating from Stanford with a degree in Symbolic Systems, joined Google to help build AdWords and design Google’s front-end. Wojcicki and Mayer would soon be joined by Sheryl Sandberg, who came to Google in 2001 as Vice President of Online Sales and Operations. Another now-famous early female employee was Kim Scott, author of Radical Candor, who joined the company in 2004. All of these early, powerful female leaders, with the continued urging of Larry and Sergey (who wanted to achieve a 50/50 ratio of male to female employees) helped build a strong culture of female leadership. But as the Company scaled it lost sight of its gender diversity goals – “In 2017, women accounted for 31% of employees overall, 25% of leadership roles and 20% of technical roles.” Google claims it lost touch as it scaled, when the need for hiring outpaced the ability to find qualified and diverse candidates – but that sounds like an easy cop out.

Startups and Party Culture. Atari and Trilogy Software pioneered the idea of a work-hard, play-hard startup cultures. Nolan Bushnell of Atari would throw wild parties and have employees (including Steve Jobs) work late into the night, building for the company. Trilogy, a provider of sales and marketing software, extended this idea even further. It started with hiring, where, according to a former engineer, Trilogy’s ethos was: “We’re elite talent. It’s potential and talent, not experience, that has merit.” The Company regularly used complicated brain-teasers in interviews and attracted swaths of anti-social engineers with young and attractive talent recruiters. Joe Liemandt, the CEO of Trilogy, also moved the company to Austin, Texas; executives likened the tactic to marooning members of a cult. Co-founder Christy Jones remarked: “I didn’t go on vacation. We called holidays competitive advantage days because no one else was working. It was a chance to get ahead.” The Company had a strong drinking and partying culture and bares striking cult-like resemblance to WeWork, except it had a sustainable business model. Other technology companies have mixed constant alcohol and long hours, which has led to numerous assault charges at well-known startups including Uber, Zenefits, WeWork and others. Startup and party culture does not need to be so intertwined.

Hiring Practices to Encourage Diverse Backgrounds. Stewart Butterfield, the founder of Flickr (sold to Yahoo for $20 million in 2005), has focused on diverse hiring efforts at his new company Slack. According to Brotopia, “In 2017, Slack reported that 43.5% of its employees were women, including 48% of managers and almost 30% of technical employees – far better numbers than any tech company in Silicon Valley.” Butterfield, who grew up on a commune in Canada, recognizes his privilege, and discusses its not insanely difficult to create a diverse environment: “As an already successful, white, male, straight – go down the list – I’m not going to have the relevant experience to determine what makes this a good workplace, so some of that is just being open but really just making it an explicit focus.” Slack’s diverse recruiting team was given explicit instructions to source candidates from underrepresented backgrounds and schools for every new role in the organization. More companies should follow Slack’s lead and adopt explicit gender and diversity goals.