This month we dive into head of Sinovation Ventures, Kai Fu Lee’s book on the future of AI. I disagree with a lot of this book, and overall found it underwhelming. However, there are some interesting ideas that people can take with them into the future.

Tech Themes

Competitive Intensity in China. China's tech industry is fiercely competitive due to the sheer size of its market and the government's support for innovation. Local players like Baidu, Alibaba, and Tencent (BAT) have dominated the industry for years, but new players are emerging every day. This intense competition has created a dynamic tech ecosystem where companies constantly innovate and disrupt traditional industries. The race to dominate emerging technologies like AI, cloud computing, and 5G is particularly intense as these technologies have the potential to reshape entire industries. The markets are so competitive that entrepreneurs use almost absurd tactics to beat out rivals. In one instance, a new social network named Kaixin001 was gaining in popularity. The company was new and didn’t have enough cash to buy the Kaixin.com domain name, so its number one competitor Renren built an exact copy of Kaixin001’s website and bought the Kaixin.com domain name to launch the product. Within months their traffic plummeted and although they eventually won a lawsuit for unfair competition, the $60,000 reward was nothing compared to the loss of customers. Renren itself was a clone of Twitter, started by Wang Xing, the eventual founder of Meituan. In another instance, Tencent and Qihoo 360 got in a repeated blame-game fight, that eventually led to Qihoo Anti-Virus blocking the use of Tencent’s QQ and Tencent suing Qihoo in the first-ever Anti-Monopoly court case. The Groupon Clone Wars were a series of intense price wars between Chinese group buying sites like Meituan and Dianping. At one point, China had 6,000 group-buying sites. These sites copied Groupon's business model of offering discounts on local goods and services but adapted it for the Chinese market. The result was a hyper-competitive market where companies would aggressively discount their services to attract customers. This competition was good for consumers but ultimately unsustainable for the companies involved. Meituan and Dianping have merged to form a dominant force in China's online-to-offline (O2O) market. This merger directly opposed Alibaba’s wishes, and it massively funded competitor Ele.Me to compete. Today, Bytedance and Alibaba are suing Tencent and Meituan over monopolizing the food delivery industry. The competition in China is absolutely brutal - copying isn’t just allowed, it’s encouraged.

AI in Practice. Meituan Dianping and Bytedance are two of China's most successful tech companies. Meituan Dianping started as a group buying site for food and beverage deals but has since expanded into other verticals like travel and entertainment. Bytedance, on the other hand, is the company behind TikTok. Both companies have experienced explosive growth in recent years and are now among the most valuable startups in the world. Their success is a testament to China's ability to create homegrown tech giants that can compete on a global stage. Tiktok has built one of the best and most successful content recommendation algorithms ever. Alibaba's customer service chatbot, AliMe, uses natural language processing to understand and respond to customer queries. It can handle over 90% of customer inquiries without human intervention, allowing for quick and efficient responses. Another example is China Merchants Bank, which uses facial recognition technology to identify customers and provide personalized services. AI-powered recommendation systems are also being used by companies such as JD.com to suggest products based on customers' browsing and purchasing history. Furthermore, AI-powered voice assistants, like those developed by iFlytek and Baidu, are being used to help customers with tasks such as ordering food, booking hotels, and making payments. By leveraging AI technology, Chinese companies can provide customers with faster, more personalized, and more efficient service, ultimately leading to greater customer satisfaction and loyalty.

Chinese Government Investment in AI. China has become a hotbed for entrepreneurship in recent years, with startups popping up in every industry, from e-commerce to healthcare. The government has made it a priority to encourage innovation and entrepreneurship through initiatives like the "Made in China 2025" plan. The rise of angel investors and venture capitalists has also made it easier for entrepreneurs to raise funding. However, the market is still highly competitive, and success is far from guaranteed. The government has set ambitious targets for the industry, including the goal of making China the world's primary AI innovation center by 2030. China is expected to double its investment in AI to $27B by 2026, a simply astounding figure.

Business Themes

Mobile Payments and AI. Mobile payments have exploded in China, with platforms like Alipay and WeChat Pay becoming ubiquitous. China's large population and relatively low adoption of credit cards have made it an ideal market for mobile payments. Today, mobile payments are used for everything from paying for groceries to renting bikes. The convenience of mobile payments has also fueled e-commerce growth, as consumers can easily make purchases on their phones. The future of mobile payments in China looks bright, with experts predicting continued growth and innovation.

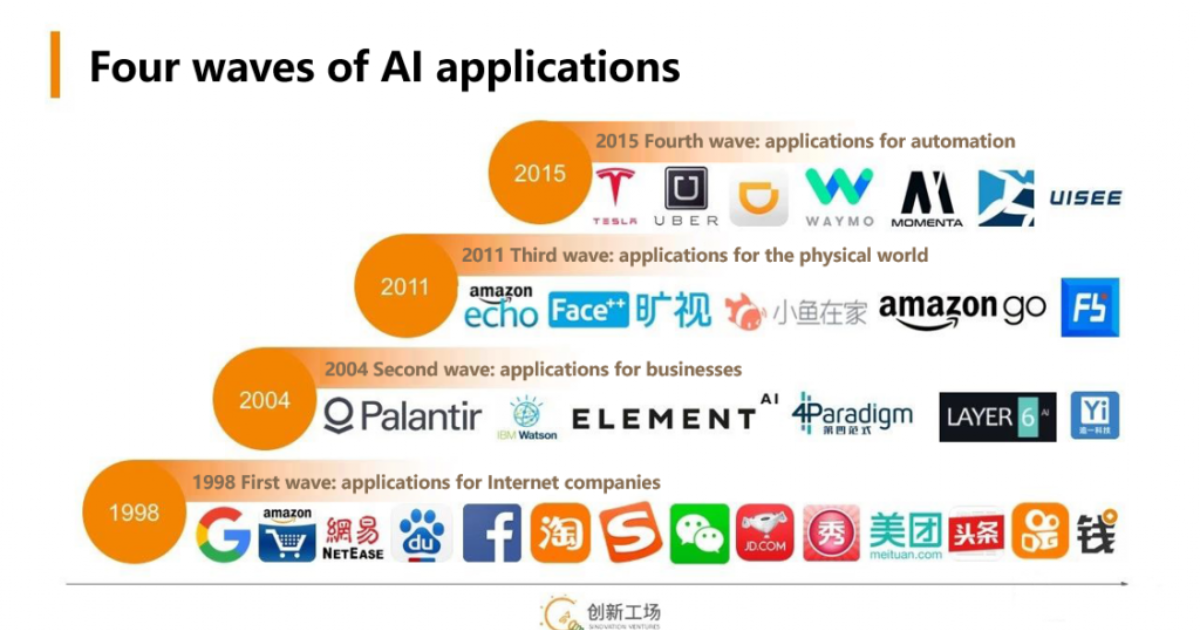

Four Types of AI. Lee categorizes AI into four types: internet AI, business AI, perception AI, and autonomous AI. Internet AI refers to algorithms that are used to power online services like search engines and recommendation systems. Business AI is used to optimize business processes and improve efficiency. Perception AI is used to analyze and understand visual and auditory data. Autonomous AI is used to power self-driving cars and other autonomous systems. Each type of AI has its own unique challenges and opportunities, and companies are investing heavily in each area to gain a competitive advantage.

The future of the Chip Industry. In December China announced an absolutely massive stimulus to the chip industry: “China is working on a more than 1 trillion yuan ($143 billion) support package for its semiconductor industry, three sources said, in a major step towards self sufficiency in chips and to counter U.S. moves aimed at slowing its technological advances.“ One of the big geopolitical challenges of today’s age is the role of TSMC in the chip industry. “‘TSMC is just absolutely critical,” says Peter Hanbury, a semiconductor specialist at the Bain & Co. consulting firm. “They basically control the most complicated part of the semiconductor ecosystem, and they’re a near monopoly at the bleeding edge.’” With TSMC located in Taiwan, the proximity to China can be concerning for the US, especially with China repeatedly ratcheting up the tensions. China’s domestic chip industry has not been able to reach the pinnacle of chip development, which is no easy feat. TSMC believes that excellence only comes from rigorous kaizen process and is not the result of larger investment dollars. Only time will tell who will win the chip wars.

Dig Deeper