This month we look at how Satya Nadella reignited Microsoft’s fire and attacked new spaces with a growth mindset. The book is loaded with excellent management philosophy and complex Microsoft history.

Tech Themes

Bing: The Other Search Engine. After starting at Microsoft as an engineer and rising through the ranks to lead Microsoft Dynamics (its CRM product), Nadella was handpicked to lead the re-launch of a brand new search engine, Microsoft Bing. Bing was one of Microsoft’s first “born-in-the-cloud” businesses and Nadella quickly recognized four core areas of focus: distributed systems, consumer product design, understanding the economics, of two-sided marketplaces, and AI. Microsoft had a troubled history with search engines and wanted to go big quickly, submitting an offer to buy Yahoo for $45B in February of 2008. Microsoft was rebuffed and thus Nadella found himself launching Search Checkpoint #1 in September of 2008 ahead of a June 2009 Bing launch. What are the odds that Microsoft’s future CEO would have early cloud, distributed systems, and advanced AI leadership experience? It was an almost prescient combination!

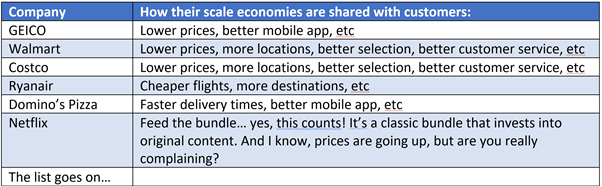

Red Dog to Azure. Microsoft started working on the cloud two years after Amazon launched AWS. In 2008, veteran software architects Ray Ozzie and Dave Cutler created a secret team inside Microsoft known as Red Dog, which was focused on building a cloud infrastructure product. Red Dog was stationed under Microsoft’s Servers and Tools business unit (STB), with products such as Windows Server and Microsoft’s powerful RDBMS, SQL Server. In 2010, Microsoft CEO Steve Ballmer asked Nadella to lead the STB business unit and set the vision for their then single-digit millions cloud infrastructure business. It was a precarious situation: “The server and tools business was at the peak of its commercial success and yet it was missing the future. The organizing was deeply divided over the importance of the cloud business. There was constant tension between diverging forces.” How did Nadella resolve this tension? It was simple - he made choices and rallied his team around those decisions. He focused the team on hybrid cloud, data, and ML capabilities where Microsoft could take advantage of its on-premise, large enterprise heritage while providing an on-ramp for customers eager to make the shift to the cloud. Microsoft has since surged to an estimated 20% worldwide market share making it one of the biggest and fastest-growing products in the world!

Re-Mixed Reality. Microsoft’s gaming portfolio is impressive: Xbox, Mojang (aka Minecraft), Zenimax Media (Maker of Fallout, Wolfenstein, and DOOM). Microsoft also owns the Hololens, a virtual reality headset that competes with Facebook’s Oculus. Many believe the future computing generations will take place in virtual reality, augmented, or mixed reality. Nadella doesn’t mince words - he believes that the future will not be in virtual reality (as Facebook is betting) but rather in mixed reality, a combination of augmented reality (AR) and virtual reality, where the user experiences an augmented experience but still maintains some semblance of the outside world. Nadella lays out the benefits: “HoloLens provides access to mixed reality in which the users can navigate both their current location - interact with people in the same room - and a remote environment while also manipulating holograms and other digital objects.” Virtual reality blocks out the outside world, but that can be an overwhelming experience and impractical particularly for enterprise users of AR/VR/MR technologies. One of the big users of the HoloLens is the US Army, which recently signed a rumored $22B deal with Microsoft. It is still early days, but the future needs a new medium of computing and it might just be mixed reality!

Business Themes

Leading with Empathy. Satya Nadella’s life changed with the birth of his son. “The arrival of our son, Zain, in August 1996 had been a watershed moment in Anu’s and my life together. His suffering from asphyxia in utero had changed our lives in ways we had not anticipated. We came to understand life as something that cannot always be solved in the manner we want. Instead, we had to learn to cope. When Zain came home from the intensive care unit, Anu internalized this understanding immediately. There were multiple therapies to be administered to him every day, not to mention quite a few surgeries he needed that called for strenuous follow-up care after nerve-racking ICU stays…My son’s condition requires that I draw daily upon the very same passion for ideas and empathy that I learned from my parents.” Nadella reiterates the importance of empathy throughout the book, and rightly so, empathy is viewed as the most important leadership skill, according to recent research. How does one increase empathy? It’s actually quite simple - talk to people! Satya understands this: “It is impossible to be an empathetic leader sitting in an office behind a computer screen all day. An empathetic leader needs to be out in the world, meeting people where they live, and seeing how the technology we create affects their daily activities.” Leadership requires empathy - hopefully, we see more of it from big technology soon!

Frenemies. One of the first things that Satya Nadella did after taking over the CEO role from Steve Ballmer in 2014 was reach out to Tim Cook. Apple and Microsoft had always had a love-hate relationship. In 1997, Microsoft saved Apple shortly after Steve Jobs returned by investing $150M in the company so that Apple could stave off potential bankruptcy. However, in 2014, Nadella called on Apple: “I decided we needed to get Office everywhere, including iOS and Android…I wanted unambiguously to declare, both internally and externally, that the strategy would be to center our innovation agenda around users’ needs and not simply their device.” Microsoft had tried to become a phone company with Windows Mobile in 2000, tried again with Windows Phone in 2010, and tried even harder at Windows Phone in 2013 with a $7.2B acquisition of Nokia’s mobile phone unit. Although Nadella voted ‘No’ on the deal before becoming CEO, he was forced to manage the company through a total write-off of the acquisition and the elimination of eighteen thousand jobs. So how could Nadella catch up to the mobile wave? “For me, partnerships - particularly with competitors - have to be about strengthening a company’s core businesses, which ultimately centers on creating additional value for the customer…We have to face reality. When we have a great product like Bing, Office, or Cortana but someone else has created a strong market position with their service or device, we can’t just sit on the sidelines. We have to find smart ways to partners so that our products can become available on each other's popular platforms.” Nobody knows platforms like Microsoft; Bill Gates wrote the definition of a platform: “A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it.” Nadella got over his predecessor’s worry and hatred of the competition to bring Microsoft’s software to other platforms to strengthen both of their leadership positions.

Regulation and Technology. Nadella devotes an entire chapter to the idea of trust in the digital age. Using three case studies - North Korea’s attack on Sony’s servers, Edward Snowden’s leaked documents (that were held on Microsoft’s servers), and the FBI’s lawsuit against Apple to unlock an iPhone that might contain criminal information - Nadella calls for increased(!) regulation, particularly around digital technology. Satya uses a simple equation for trust: “Empathy + Shared values + Safety and Reliability = Trust over time.” Don’t you love it when a company that the government sued over anti-trust practices calls on the government to develop better laws! You’d love it even more if you saw how they used the same tactics to launch Microsoft Teams! Regulation in technology has been a hot topic recently, and Nadella is right to call on the government to create new laws for our digital world: “We do not believe that courts should seek to resolve issues of twenty-first-century technology relying on law that was written in the era of the adding machine.” He goes further to suggest potential remedies, including an efficient system for government access to corporate data, stronger privacy protections, globalized digital evidence sharing, and transparency of corporate and government data. I imagine the trend will be toward more regulation, especially with the passage of recent data laws like GDPR or CCPA, but I’m not sure we will see any real sweeping changes.